Coronavirus and digital media industry trends: 3/27/20

Just over two weeks since marked economic impacts from Coronavirus began here in the US, digital advertising has continued to trend downwards. As the Coronavirus pandemic spreads across the country and world, more advertisers are reducing their ad budgets for...

Just over two weeks since marked economic impacts from Coronavirus began here in the US, digital advertising has continued to trend downwards. As the Coronavirus pandemic spreads across the country and world, more advertisers are reducing their ad budgets for a variety of reasons.

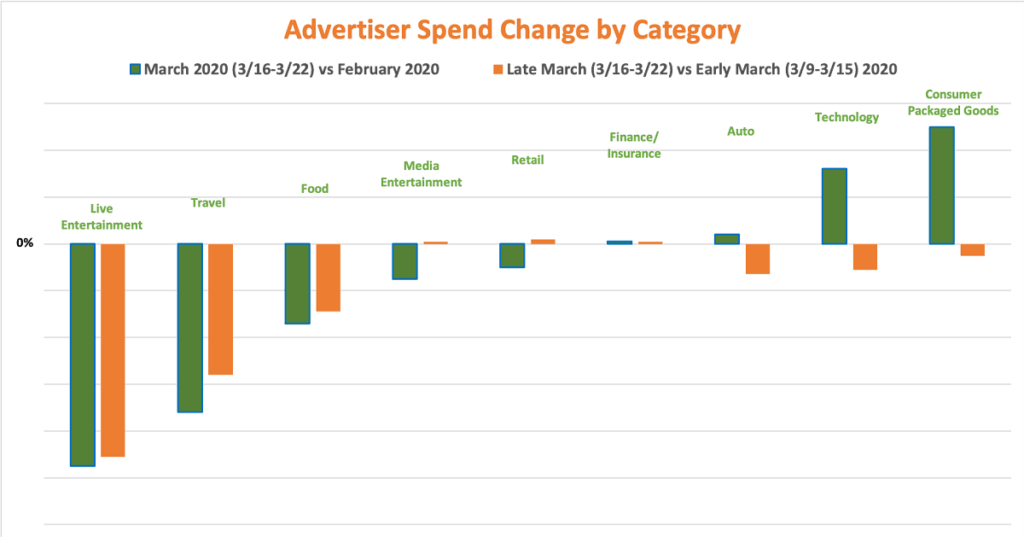

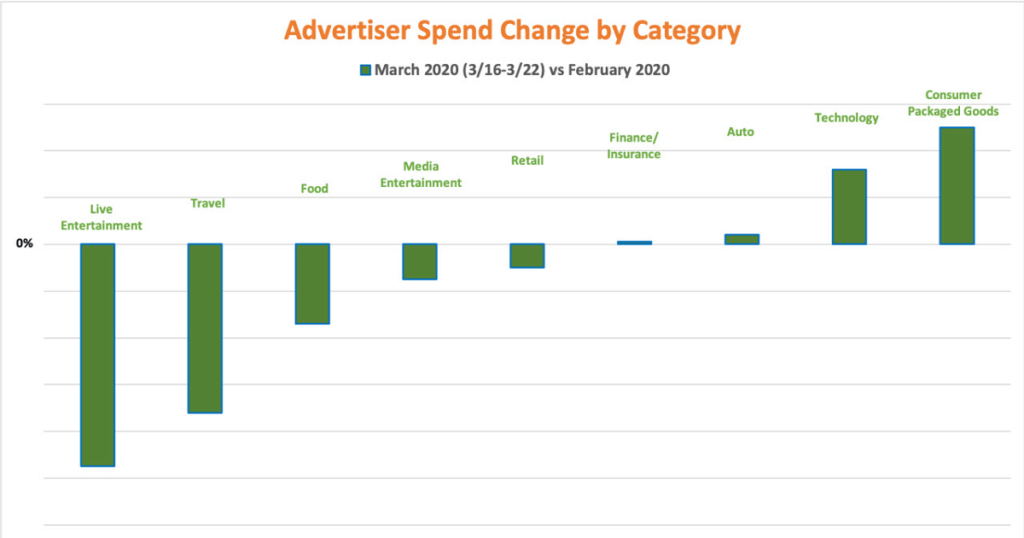

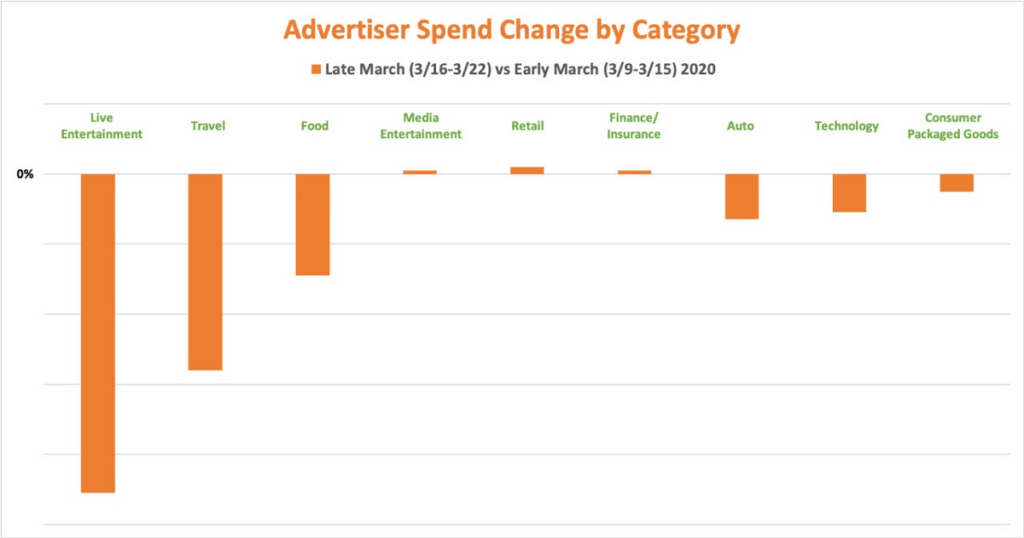

Clear and varied trends have emerged by category

Note: Data represents a subset of CafeMedia advertisers and advertising technology partners

Last week vs. February:

Travel and live entertainment took huge cuts for obvious reasons. Food also experienced reduction in spend as stores ran out of supply or advertisers feared future shortages.

On the flip side, consumer packaged goods increased as a result of consumer demand. Technology also grew as the workforce adapted to remote work and set up home offices.

Week over week:

Retail and entertainment – down from February – are stabilizing. Much of entertainment’s movie theater spend reduction has shifted to streaming services and other home-oriented products.

Advertisers are reducing spending on Coronavirus-adjacent keywords

In addition to advertiser pullback on content containing “coronavirus” and “covid”, Coronavirus-adjacent keywords have also experienced a less dramatic decline in spend:

- Quarantine

- Emergency

- Vaccine

- Symptoms

- Pandemic

- Flu

- Virus

- Shelter in place

- Epidemic

- Social distancing

Increased traffic from users seeking this type of content can counterbalance reduced revenue; one strategy is to use these keywords to promote content via social or newsletters while avoiding the keywords in the content itself.

Video remains relatively strong

While display advertising has declined, video RPMs have remained resilient, serving as a buoy or opportunity for publishers.

Opting-in to additional categories may boost revenue

Enabling additional categories doesn’t guarantee a windfall but may add a few percentage points’ increase to RPM.

Four categories offering potential tangible impact:

- Drugs and supplements: Pharmaceuticals, vitamins, supplements and related retailers

- Significant skin exposure: Lingerie and swimsuit ads

- Social Casino Games: Simulated gambling games like poker, lotteries, sports betting, and other card games and casino games (without actual money or prizes)

- Politics: Possibly the most upside; includes ads for political campaigns and candidates, as well as potentially controversial social issues or events like elections, protests, abortion, animal testing, etc.

Looking ahead to Q2

Ad spend nearly always drops as a new quarter begins and advertisers start fresh budgets, followed by a gradual ramp as the quarter progresses.

This Q2 will look different from years past. Advertisers have been adjusting their budgets in the wake of Coronavirus and likely will enact significantly altered strategies for the next 3 months.

Expect a steeper drop than normal at the beginning of the quarter, and the typical RPM recovery that takes place in subsequent weeks may not occur. This is purely speculative, but under such unusual economic circumstances we’d rather plan for the worst and hope for the best.

Additional trends

Many advertisers have cut their budgets because they don’t want to appear insensitive. Efforts are centered around retooling and modifying existing creatives and copy.

A few advertisers have launched new, adapted campaigns – eg, Hyundai and Toyota’s new campaigns and Nike’s new “Play Inside” messaging – with more likely to pick up over the next few weeks.

Additionally, with nearly every major sporting event cancelled and the Olympics pushed to 2021, a significant amount of ad spending must be redeployed. Some will be cut entirely and some will remain with other channels like television, but there’s potential for such budgets to migrate to digital media.

What we’re doing

Talking to advertisers

We continue to have conversations with our major advertising partners to educate them on trends and work with them to modify campaigns.

Although they have been cutting budgets in recent weeks, we’ve started to see positive signals – advertiser restarting campaigns or launching new ones. As mentioned, April could be very rocky, but there are some slight positive signs out there.

Working to safeguard publishers

Times of crisis can bring out the best in people but can also bring out the worst. We’re seeing a rise in fraudulent companies reaching out to publishers with “too good to be true” offers as well as a spike in bad ads.

Our partners at Confiant block the vast majority of these ads, but if you notice anything suspicious please reach out.

Doubling down on improvements

We’re also hard at work on a number of new optimizations. While we can’t force advertisers to spend more, we can make our advertising placements more attractive to them. We have a big focus on our video players and improving the user experience, since a better experience for users is good for publishers and advertisers.

We’ll continue to share updates as the situation changes — meanwhile, stay safe and be well!